Elasticity of Demand

The term elasticity shows the reaction of one variable with respect to a change in other variables on which it is dependent. In economics, the term elasticity refers to a ratio of the relative changes in two quantities. It measures the responsiveness of one variable to the changes in another variable.

The elasticity of demand measures the sensitiveness of a change in quantity demanded of a commodity due to a given change in its price.

According to Mrs. Joan Robinson, "The elasticity of demand, at any price or at any output, is the proportional change of amount purchased in response to a small change in price divided by the proportional change of price."

According to Marshall, "The elasticity of demand in a market is great or small according to as the amount demanded increases much or little for a given fallen price, and diminishes much or little for a given rise in price."

Thus it is clear that elasticity depends primarily on proportional or percentage changes and not on absolute changes in price and quantity demanded.

Price-Elasticity of demand measures the responsiveness of quantity demanded of a commodity to a change in its price.

It can be expressed as follows: % Δ Quantity Demanded

PED = ————————————–

% Δ Price

Generally, the co-efficient of price-elasticity of demand always holds a negative sign because there is an inverse relationship between the price and quantity demanded.

Symbolically,

The value of elasticity coefficients will vary from 0 to infinity. There are 5 types of price elasticity of demand:

Perfectly elastic demand: In this case, a very small change or no change in price causes an infinite change in quantity demanded. The demand curve is a horizontal line and parallel to ox axis.

Perfectly inelastic demand: In this case, any change in price leaves quantity demanded unchanged. The demand curve is a vertical straight line and parallel to oy axis.

Relatively elastic demand: In this case, the change in demand is more than that of the price, or we can say that the percentage change in quantity demanded exceeds the percent change in price. hence, the elasticity is greater than one. Relatively elastic demand is generally called 'elastic demand' or 'more elastic demand'. In this case, the demand curve is relatively flat.

Relatively inelastic demand: In this, a huge change in price leads to less than proportional change in demand. In other words, the percentage change in quantity demanded falls short of the percentage change in price. This can be represented by a steeper demand curve. Hence, elasticity is less than one. Relatively inelastic demand is popularly known as 'inelastic demand' or 'less elastic demand'.

ED<1

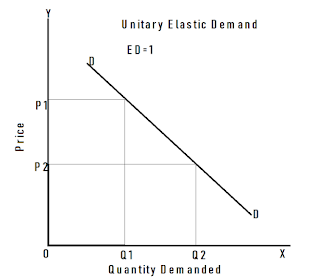

Unitary elastic demand: In this, there is a proportionate change in price leads to an equal proportional change in demand. Hence, elasticity is equal to unity. The demand curve is non-linear. The shape of the curve is known as a rectangular hyperbola.

Determinants of price elasticity of demand:

1. Nature of the commodity: If the good belongs to our necessity, then it will be inelastic as price does not affect much on necessaries and essential goods such as rice, wheat, salt, sugar, etc. On the other hand luxury goods consist of elastic demand such as cars, refrigerators, etc.

2. Availability of substitutes: For substitute goods, demand tends to be elastic such as tea, coffee. If a commodity has no substitutes, then demand tends to be inelastic such as salt.

3. Number of uses for the commodity: The demand for single-use goods tends to be inelastic such as all eatable items, seeds, fertilizers, etc. On the contrary, the demand for multiple-use goods tends to be elastic for example coal, electricity, etc.

4. Proportion of total expenditure: If a consumption good absorbs only a small proportion of total expenditure, the demand will not be much affected by a change in price, e.g. salt. Conversely, if any good absorbs the bulk of total expenditure, the demand will be elastic, e.g clothes.

5. Durability and repair ability of a commodity: Demand tends to be elastic for durable and repairable goods because people don't buy them frequently, for example, furniture, vessels, etc. On the contrary, for perishable goods, demand tends to be inelastic e.g vegetables, milk, etc.

6. Habits: If a person is habituated to the use of a commodity, he does not bother for the price changes over a certain range and demand tends to be inelastic for these goods such as cigarettes, liquor, etc. and vice versa.

7. Possibility of postponing the use of a commodity: If there is a possibility to postpone the use of a commodity, demand tends to be elastic such as t.v, car, washing machine, etc. If there is no possibility to postpone the use of a commodity, demand tends to be inelastic, e.g. medicines

8. Level of incomes: The demand for a good for the rich will be inelastic because any change in market price will not affect the purchase plans of a rich. On the other side, it will be elastic for the poor.

9. Joint demand: demand for complementary goods is inelastic in nature. For example- pen and ink, car and petrol, tea and sugar. Goods that are not jointly demanded are elastic in nature. For example- chocolate.

10. Period of time: The elasticity of demand is greater in the long run than in the short run as the consumer has more time to make adjustments in his scheme of consumption in a long period.

11. Ranges of price: The demand for very high priced goods tends to be inelastic in nature,e.g diamond. Similarly, low priced goods tend to be inelastic in nature such as needles, salt. Commodities having normal prices are elastic in nature, e.g clothes.

Practical application of price elasticity of demand:

1. Production planning: If the demand for the product is inelastic, then there will be very little change in demand and so on production, while different quantities have to be produced in case of goods having more elasticity.

2. Helps in fixing the prices of different goods: It helps a producer to fix the price of his product. If the demand is inelastic for the products, then an increase in price will lead to higher revenues but, in the case of elastic demand products, he cannot increase in price as it will lead to a fall in demand and so in revenues.

3. Price discrimination: When a monopolist sells his product at different prices at different places, it is called price discrimination. Monopolist charges high price at that place where the demand for his product is inelastic and fixes low price where the demand for his product is elastic.

4. Fixing the rewards for factor inputs: If the demand for any factor is inelastic, the producer has to pay a higher reward for it or vice versa.

5. Helps in determining the foreign exchange rates: It is also helpful in determining the exchange rates between the currencies of two different nations. If the demand for the currency of any nation to an Indian rupee is inelastic, then an Indian has to pay more rupee in exchange for that nation's currency and vice-versa.

6. Helps in fixing the rate of taxes: The government imposes more taxes on those goods for which the demand is inelastic and can increase the tax revenue while a tax on an elastic good will not create much tax revenue.

7. International trade: It is the basis for deciding the term of trade between the two nations. If the demand for other nation's products in India is inelastic, in that case, Indians have to pay more to get one unit of a commodity of that nation and vice-versa. The terms of trade imply the rate at which the goods of one country are exchanged with the goods of another country.

8. Economic policies: The government considers the nature of consumer demand while making economic policies. The government can create public utilities or may declare a particular industry as 'public utility' or nationalize it if the demand for its product is inelastic.

9. Poverty in plenty: The concept of elasticity explains the paradox of poverty in the midst of plenty. Larger output, at times, makes the producer to suffer economically. For example, foodgrains are perishable and inelastic in nature, if there is a bumper stock of these types of crops, demand for these products will not be high and the incomes of the farmers would remain the same.

Income Elasticity of Demand: The income elasticity of demand is defined as the proportionate change in the quantity demanded resulting from a proportionate change in income. In other words, it indicates the extent to which demand changes with a variation in consumer's income.

where Y= income

ΔY= change in income

Q= quantity demanded

ΔQ= change in quantity demanded

Income elasticity of demand is generally positive for all normal goods. It indicates that the demand for the commodity increases with an increase in the level of income.

It is negative for inferior goods. Negative income elasticity of demand indicates that the demand for the commodity decreases with an increase in the level of income.

1. If income elasticity of demand is greater than one, the commodity is luxury.

2. If the income elasticity of demand is less than one, the commodity is essential.

3. If income elasticity of demand is zero, the commodity is neutral or inelastic in demand such as salt.

Cross Elasticity of Demand: Cross elasticity of demand measures the responsiveness of quantity demanded of one commodity to change in the price of another commodity. It arises in the case of substitutes and complements.

1. If the commodities are good substitutes, then cross elasticity of demand will be positive. e.g.coffee and tea.

2. If the commodities are independent of each other, then cross elasticity demand will be zero.

3. If the commodities are complements of each other, then cross elasticity demand will be negative.

Dr. Swati Gupta

Want to understand the concepts of Economics in a simple and better way?

Please click on the image below to subscribe to this channel.

Excellent

ReplyDeleteImpressive

ReplyDeleteGood explanation

ReplyDeleteNicely Explained each point. Thanks mam.

ReplyDeleteYour blogs have helped me pass my weekly test. Thx.

ReplyDeleteThnax for the blog.

ReplyDeleteVery nicely explained

ReplyDelete