Consumers equilibrium through indifference curve and budget line

Consumer's Equilibrium: The consumer is said to be in equilibrium when he maximizes his total utility, given his income and market price of the goods he consumes. The ordinal utility approach specifies two important tools for the consumer's equilibrium mentioned below:

1. consumer's indifference map,

2. budget line.

Two conditions must be fulfilled for the consumer's equilibrium: The first condition is that the marginal rate of substitution should be equal to the ratio of commodity prices.

MRSxy =

MUxMUy = PxPy

This is necessary but not a sufficient condition for the consumer's equilibrium.

The second condition is that the indifference curve should be convex to the origin and the necessary condition is fulfilled at the highest possible indifference curve.

In the diagram, the consumer will be in equilibrium at the point Q where he will buy OM quantity of good X and ON quantity of good Y. The consumer will maximize his satisfaction at this point. Q point in our diagram lies in the indifference curve IC3. This is the highest indifference curve to which he can go, given the money and prices of the goods in the market. Any combination other such as R, S, T, H, then Q on the given price line can be shown to give less satisfaction to the consumer as they are on the lower indifference curve IC1 and IC2.

In equilibrium at point Q, the marginal rate of substitution of good X for good Y is equal to the price ratio between these two goods, since both the indifference curve IC3 and the price line AB have the same slope at point Q.

Income Effect: When a consumer's income changes, his capacity to buy goods and services changes too, while other things remaining the same. As a result of a change in income, his satisfaction will either increase or diminish. This type of result is described as an income effect.

An income consumption curve [ICC] shows the equilibrium combinations of two commodities, X and Y, purchased at various levels of money income, while prices of both the goods remaining unchanged.

In the above diagram, with the price-income line A1 B1, the consumer is in equilibrium at point Q1. Suppose the income of the consumer increases, his new price line will be A2 B2. As a result of an increase in income, the consumer will move to a new equilibrium at point Q2 on a higher indifference curve IC2 where he is buying OM2 quantity of good X and ON2 quantity of goodY. At this new point, the consumer will get a higher level of satisfaction as a result of an increase in income.

If the income increases still further, the new price line A3 B3 will move to the right on the higher indifference curves and he will be in equilibrium at the point Q3 and so on for the further increases in income.

Thus we get various points of equilibrium such as Q1, Q2, Q3, and Q4 for different levels of income, prices of the goods remaining the same. If we joint the points Q1, Q2, Q3, and Q4 together by a line passing from the origin, we get Income Consumption Curve.

Thus, the income consumption curve finds out the income effect as the consumer's income changes, with given related prices of the two goods.

In the case of normal goods, the income effect is positive and for inferior goods, it will be negative. An inferior good is one in which consumption decreases with the increase in income.

In the case of good X is inferior, the income consumption curve begins to move towards the OY axis. It shows that after a certain point, as income rises, less of good X is bought.In the case of good, Y is inferior, ICC begins to move towards the OX axis. It shows that after a certain point, as income increases, less of good Y is bought.

Thus, the income consumption curve may take various shapes depending on whether a commodity is a normal good or inferior good.

Price Effect: The price effect is defined as the total change in the quantity consumed of a commodity due to a change in its price.

In this diagram, suppose with the certain fixed income and given market price of the two goods represented by the price income line AB, the consumer is in the equilibrium at point Q. Suppose if the price of good X falls, income and price of remaining Y unchanged so that the new price income line becomes AB1, the consumer will be in equilibrium at point R on the indifference curve IC2. If the price of good X falls further, the new price line becomes AB2 and the new equilibrium point will be S in the indifference curve IC3 where he will be purchasing more units of good X [OB2] than before.

When all the points Q, R, S, T are joined together, we get the price consumption curve [PCC] of the consumer for good X.

PCC shows the price effect of how the consumption of commodity X changes, as its price changes, the consumer's income, and the price of Y remaining the same.

Substitution Effect- It means the change in the quantity of a commodity purchased which is due only to the change in the relative prices, while money income remaining constant.

In the diagram, the consumer is in equilibrium at point S where the price line AB is tangent to the IC1. When the price of the good X falls, while the price of good Y and money income remains constant, the new price line would be AB1, and the consumer will be in equilibrium at the point U at IC2. To find out the substitution effect, the consumer's money income must be reduced by an amount so as to reduce in real income that results from a price fall. For it, we draw a hypothetical price line LM parallel to the price line AB1 so that it should touch the IC1. AL in terms of good Y is the amount of money income that should be taken away from the consumer to cancel the gain in real income. Movement from S to T on the same indifference curve IC1 is due only to the relative fall in the price of X. At point T, the consumer buys OR quantity of good X which is more than OQ. The change in the quantity QR is the substitution effect.

Thus the substitution effect can be defined as the change in the quantity demanded as a result of a change in the relative price after the consumer has been compensated for a change in his real income. That is, there is a movement along with the original IC, real income remaining the same.

Income and Substitution Effects of Price Change: When the price of good changes, other things remaining constant, it creates two effects: income -effect, and substitution effect.

Income-effect results from the increase in real income due to a decrease in the price of a commodity. This change in real income leads to an income effect on the quantity demanded. The income effect of a price change may be positive or negative.

Substitution-effect is because of the consumer's inherent tendency to substitute cheaper goods for the relatively expensive ones. The substitution effect of a price change is always negative. It means that the price of a good X and the quantity demanded of good X always move in the opposite direction.

Thus, the price effect is the total change in quantity demanded as the consumer moves to one equilibrium to another.

The substitution effect is the change in quantity demanded because of the change in the relative price after compensating the consumer for the change in real income.

The income effect is the change in the quantity demanded resulting exclusively from a change in real income.

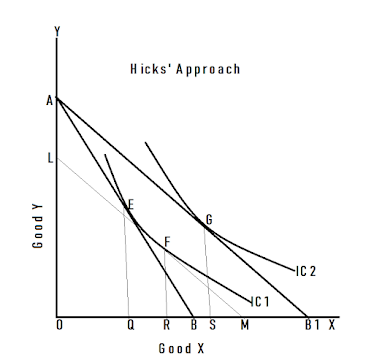

Hicks' Approach:

Hicks Approach on Income and Substitution Effect

The Hicks method of separating income and substitution effects of a price change is illustrated in the above diagram. The initial equilibrium of the consumer is at E point, where the indifference curve IC1 is tangent to the budget line AB. At this equilibrium point, the consumer consumes the OQ quantity of commodity X. Assume that the price of commodity X decreases (income and the price of other commodities remain constant). The consumer will move to the new budget line AB1 and to the new equilibrium point G, where the new budget line AB1 is tangent to IC2. Thus, there is an increase in the quantity demanded of commodity X from Q to S.

An increase in the quantity demanded of commodity X is caused by both the income effect and the substitution effect. In order to separate these two effects, we need to keep the real income constant by eliminating the income effect, so that we can calculate the substitution effect.

According to the Hicksian method of eliminating the income effect, we just reduce consumer’s money income (by way of taxation), so that the consumer remains on his original indifference curve IC1. Reduction in consumer’s money income is shown by drawing a price line LM parallel to AB1. At the same time, the new parallel price line LM is tangent to the indifference curve IC1 at the point F. Hence, the consumer’s equilibrium changes from E to F. An increase in quantity demanded of commodity X from Q to R is complete because of the substitution effect.

We get the income effect by subtracting the substitution effect QR from the total price effect QS

Income effect = QS- QR= RS

Slutsky's Approach: Slutsky also explained the substitution effect and income effect, by holding real income constant, but in a slightly different way.

In the diagram, the original budget line is AB. when the price of good X falls, the budget line changes to AB1, and the equilibrium point shifts from point R on IC1 to T On IC3.

According to Slutsky, we take away some nominal income from the consumer, so that the consumer will have to go back to point R. This is shown by drawing the income line LM passing through point R and parallel to AB1. It's the consumer's tendency to get more satisfaction than before, so he does not like to go back to R; instead, he prefers S which is on a higher indifference curve IC2 where he likes to purchase OQ2 quantity of good X.

This increase in purchase Q1Q2 of good X is considered as the substitution effect.

An increase in the quantity purchased of X from Q2 to Q3 is considered as the real income effect.

In simple words, under the Hicksian method consumer's income has to be reduced so that he moves back to his original IC curve whereas, under Slutsky's method consumer's income has to be reduced so that he moves back not only to the original indifference curve but also to his original equilibrium point R.

In short, the only difference between both approaches relates to the fact that the real income is held to be constant in different ways. Broadly, the results are the same.

Dr. Swati Gupta

Want to understand the concepts of Economics in a simple and better way?

Please click on the image below to subscribe to this channel.

Comments

Post a Comment