COLLUSIVE OLIGOPOLY: Perfect Cartel, Market-Sharing by Non-Price Competition and Output Quota Notes

COLLUSIVE OLIGOPOLY: CARTEL AS A COOPERATIVE

MODEL

The term collusion means to ‘play together’ in Economics.

In collusive oligopoly, the firms cooperate with each other in taking joint

actions to keep their bargaining position stronger against the consumer. When

government action is responsible for bringing the firms together, then it is

explicit collusion and when restrictions are introduced, firms may form

themselves into secret societies, resulting in implicit collusion. Since formal

or open agreements to form monopolies are illegal in most countries, agreements

reached between oligopolists are generally tacit or secret. When the firms

enter into such collusive agreements formally or secretly, collusive oligopoly

prevails.

Collusion may be based on either oral or written

agreements. Collusion based on oral agreement leads to the creation of what is

called as “Gentlemen’s agreement”. It does not consist of any records.

Collusion based on written agreement creates what is known

as cartels. For example, the OPEC cartel is an international agreement among

oil-producing countries which has succeeded in raising world oil prices above

competitive levels.

There are two forms of cartel:

Perfect Cartel:

Perfect cartel is an extreme form of perfect collusion. In this, the

price-output decisions for all the member firms are taken by the cartel board

of control to maximize the joint profits of the member firms. It will determine

output-quotas for members and the price they will charge. Thus, under perfect

cartel type of collusive oligopoly, the price and output determination of the

whole industry as well as of each member firm is determined by the common

administrative authority so as to achieve maximum joint profits for the member

firms. Let us suppose that the central cartel board knows the demand for the

industry output at different possible prices. It will thus calculate the

industry demand curve and its corresponding MR. Next, it will find out the

minimum aggregate cost of producing that output. Each firm is ultimately

assigned output quota in such a way that the marginal cost of producing that

output is the same for all the firms.

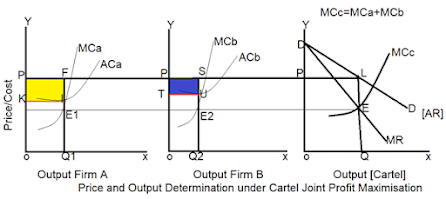

Suppose two firms have formed a cartel by entering into an

agreement. We assume that the cartel will aim at maximizing joint profits for

the member firms. First of all, the cartel will estimate the demand curve of

the industry’s product that will be sloping downward DD. Marginal revenue curve

MR will lie below the demand curve DD. Cartel’s marginal cost curve (MCc) has

been obtained by adding horizontally marginal cost curves MCa and MCb of firms

A and B respectively. Cartel’s marginal cost curve MCc will indicate the

minimum possible total cost of producing each industry output on it as it is

obtained by horizontal addition of marginal cost curves of the two firms and

each industry's output being distributed among the two firms in such a way that

their marginal costs are equal. Now, the cartel will maximize its profits by

fixing the industry's output at the level at which MR and MC curves of the

cartel intersect each other. Both cut

each other at point E and output OQ is determined and price will be QL or OP

for output OQ. Having decided the total output OQ to be produced, the cartel

will allot output quota to be produced by each firm so that the marginal cost

of each firm is the same. This can be known by drawing a horizontal straight

line from point E towards the Y-axis. It will be seen from the figure that the

marginal costs of the two firms are equal on point E1 for firm A and on E2 for

firm B. The output quota of firm A will be OQ1, and of firm B will be OQ2. It

is worth noting that the total output OQ will be equal to the sum of OQ1 and

OQ2. Thus, the determination of output OQ and price OP and the outputs OQ1 and

OQ2 by the two firms A and B will ensure the maximum joint profits for the

member firms constituting the cartel. With output OQ1 and cartel price OP, the

profits made in firm A are equal to PFKI and with output OQ2 and cartel price

OP the profits made in firm B are equal to PSTU. The sum of profits, that is,

the joint profits made by the cartel will be maximum under the given demand and

cost conditions as they have been arrived at as a result of equating combined

marginal cost (MCc) with the combined marginal revenue (MR). The allocation of

output quota to each of them is made on the grounds of minimizing cost and not

as a basis for determining profit distribution.

It results in the maximum joint profits from the industry. It is not necessary that each firm will receive its share of the total profits according to its quota. Mutual agreement and even relative bargaining strength may also determine the division of profits. Prof. J.S. Bain rightly says, “There is no particular reason for believing that the operating firms will retain just the profits resulting from the sale of their quotas, which are determined on cost grounds alone. Relative bargaining strengths will presumably determine the division of profits.”

The perfect cartel is an extreme case of collusive oligopoly. But this type of cartel is rarely found in actual. Some of the firms may press the central cartel board for an increase in quota which may lead to a higher industry output in relation to demand and the industry profits may be reduced. Some high-cost uneconomic firms may refuse to shut down despite the board's request or they may be assigned quotas on political basis. All such cases are likely to distort the profit maximization level of the cartel and perfectly collusive oligopoly is likely to be a remote possibility. Chances are greater for the individual firms to leave the cartel on account of continuous conflict of the member firms over allotment of quotas and division of profits.

Market Sharing Cartel: when

cartels are loose, the distribution of profits and fixation of outputs of

individual firms are not determined in a manner as perfect cartel does, and the

market-sharing by the firms occurs. In this form of collusion, member firms share the market on the basis of non-price competition and quota system. oligopoly firms make a cartel through an agreement and have some degree of freedom related to output selling activities and other decisions for maximizing their individual profits. In a market-sharing cartel the member firms agree on how to share the market. Each firm then operates only in one area or region agreed without

intrude on the others' region.

Market-Sharing by Non-Price Competition: Under market sharing by non-price competition, only a uniform price is set and, the member firms are free to produce and sell the number of outputs which will maximize their individual profits. The firms agree not to sell at a price below the fixed price, but they are free to promote their sales through the advertising and publicity and they may also vary the color, design, shape packing and style of their product. Thus, firms compete on non-price basis. If the different member firms have identical costs, then the agreed uniform price will be the monopoly price which will ensure maximization of joint profits. But when there are cost differences between the firms, the cartel price will be fixed by bargaining between the firms. The level of this price will be such as will ensure some profits to high-cost firms. But with cost differences such loose cartels are quite unstable. This is because the low-cost firms sometimes reduce the price to increase their profits. However, they may not openly charge lower price than the fixed one but secretly give price concessions to the buyers. However, as the rivals gradually lose their customers, they come to know that the low-cost firms are cheating them, and consequently open price war starts among them and cartel breaks down.

Market-Sharing by Output Quota: Market-sharing

by output quota cartel is the agreement between the oligopolistic firms to decide the quota of output to be produced by each of them at the agreed

price.

If all firms are producing homogeneous product and have identical costs, then they will get the monopoly power and able to maximize the joint profits and this profit will be equally shared by them. If the costs of member-firms are different, the different quotas for various firms will be fixed and, therefore, their market shares will also differ. In this case, the quotas and market shares are decided through bargaining between the firms. Two criteria [the past level of sales of the various firms and the productive capacity of the firms] are usually considered to fix the quotas of the firms during the bargaining process. Though these two criteria are not very firm as they can be easily manipulated. Mainly, the quotas fixed for various firms depend upon their bargaining power and skill.

The criteria of market sharing are the division of market on the geographical bases between the cartel firms. The agreement focuses on the sharing of the market properly among member firms so that each firm gets profits on its sales.

In this cartel, each firm will serve to a part of the industry demand and its demand curve will, therefore, be a part of the industry demand curve. Each oligopoly firm will have its own demand curve also having the same elasticity as that of the industry demand curve. If the market is to be shared equally by the oligopoly firms, their demand curve will be identical. If the market is to be shared unequally, then each firm demand curve will be different.

This diagram shows the case of equal market sharing where D, is the industry demand curve and MR/Df is its corresponding marginal revenue curve. ∑MC is the aggregate marginal cost curve of the industry.

∑MC and MR/Df intersect at E where QP [or OPo] price determine for the total industry output OQ. To know how to share the industry output equally by the firms, we have to consider the curve MR/Df as the demand curve of the firms and MRf its corresponding marginal revenue. The MC curve of the firms cuts the marginal revenue curve MRf at C. Thus, the price qL=QP is the price for the industry. The industry out-put OQ is equally shared by the firms. Profit enjoyed by each firm equals NPoLM. Thus, OQ is the profit maximization output shared by each firm at an agreed price QP(=qL). In case the cost curves or the market shares of the firms differ, each firm will charge an independent price in accordance with its own MC and MR curves. They may not necessarily sell the same quantity Oq at QP price. They may be charging a price slightly above or below the profit maximization price QP. However, each firm will try to be nearest this profit maximization price.

Conditions for cartel success: There are two conditions for cartel success. First, a stable cartel organization must be formed whose members agree on price and production levels and then adhere to that agreement. cartel members can talk to each other to formalize an agreement. However, mutual agreement is not so easy. Different members may have different costs, different assessments of market demand, and even different objectives, and they may therefore want to set price at different levels. Furthermore, each member of the cartel will be tempted to “cheat” by lowering its price slightly to capture a larger market share than it was allotted. Most often, only the threat of a long-term return to competitive prices deters cheating of this sort. Second, Potential monopoly power may be the most important condition for success; if the potential gains from cooperation are large, cartel members will have more incentive to solve their organizational problems.

Comments

Post a Comment