Investment Function

Investment Function

Generally, investment means to buy shares, stocks, bonds and securities which are already existing in stock market. But it is not considered as real investment because it is simply a transfer of existing assets and this is called financial investment. Investment is the new addition to the stock of physical capital such as plant, machines, trucks, new factories and so on that creates income and employment. According to Keynes, investment refers to real investment which adds to capital equipment. Investment includes new plant and equipment, construction of public works like dams, roads, buildings, etc. The addition to the stock of physical capital raises the level of aggregate demand which brings about addition to the level of income and employment in the economy.

Thus, investment means the sum of spending made by the business firms per unit of time to build physical ‘stock of capital’

Capital and Investment: The terms ‘capital’ and ‘investment’ are two different concepts. Capital is a stock concept. It refers to the capital accumulated over a period of time. The term ‘capital’ means stock of productive assets including business fixed investment in machinery and equipment, residential land and building, and inventories while Investment is a flow concept and it is measured per unit of time, generally one year. Thus, investment refers to the net addition to the physical stock of capital. If capital = K, then investment =∆ K = I.

Autonomous and Induced Investment:

Autonomous investment is independent of the level of income and is thus income inelastic. Autonomous investment includes expenditures on buildings, dams, roads, canals, schools, hospitals, etc. Since investment on these projects is generally associated with public policy, autonomous investment is regarded as public investment. This autonomous investment depends on population growth and technical progress. It has welfare motive. Most of the investment undertaken by Government is of the autonomous nature.

Autonomous investment is shown as a curve parallel to the horizontal axis as I1I1 curve in the above diagram. It indicates that at all levels of income, the amount of investment OI1 remains constant. The upward shift of the curve to I2I2 indicates an increased steady flow of investment at a constant rate OI2 at various levels of income.

Induced investment is that investment which is affected by the changes in the level of income. The greater the level of income, the larger will be the consumption of the community. In order to produce more consumer goods, more investment has to be made in capital goods so that greater output of consumer goods becomes possible. It has a profit motive. Induced investment is a function of income I = f(Y). It is income elastic. It increases or decreases with the rise or fall in income.

In the above diagram, induced investment is shown through I’ induced investment curve going upwards. It indicates that with the increase in national income, induced investment is also increasing.

KEYNES’S THEORY OF INVESTMENT

According to Keynes investment demand depends upon two factors: (1) expected rate of profits to which Keynes gives the name Marginal Efficiency of Capital, and. (2) the rate of interest. Investment decisions are taken by comparing the marginal efficiency of capital (MEC) with the real rate of interest (r). New investment in plant, equipment and machinery will take place until the MEC is greater than r. As more and more capital is used in the production process, the MEC will fall due to diminishing marginal product of capital. No new investment will be made in any income-earning asset after the MEC becomes equal to r.

- Rate of Interest: The rate of interest influences the level of investment in the economy. Higher interest rates reduce investment because it is more expensive to borrow money from a bank. The rate of interest is usually ‘sticky’ in the short run. Hence, the inducement to invest, by and large, depends on the marginal efficiency of capital.

- Marginal Efficiency of Capital: The marginal efficiency of capital is the expected rate of return from an additional unit of a capital asset over its cost. In simple words, it refers to the expected rate of return from the capital asset in which an entrepreneur is about to invest.

Supply price and the prospective yields of a capital asset determine the marginal efficiency of capital. The price which an entrepreneur has to pay for the particular capital asset is called its supply price or cost of capital. when an entrepreneur invests money in a certain machinery, he estimates the expected rate of profit from it. A capital asset continues to produce goods and yield income over a long period of time. Therefore, he has to estimate the prospective yield from a capital asset over his whole life period.

By deducting the supply price from the prospective yield during whole life of a capital asset the entrepreneur can estimate the expected rate of profit or marginal efficiency of capital.

In the words of Kurihara, “It is the ratio between the prospective yield of additional capital goods and their supply price.” If the supply price of a capital asset is Rs. 20,000 and its annual yield is Rs. 2,000, the marginal efficiency of this asset is

10 per cent. Thus, the marginal efficiency of capital (MEC) is the percentage of profit expected from a given investment on a capital asset.

10 per cent. Thus, the marginal efficiency of capital (MEC) is the percentage of profit expected from a given investment on a capital asset.

[The rate of discount is the investment rate of return that is applied to the present value calculation. ]

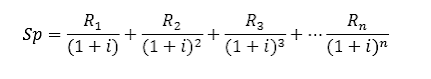

We can obtain the marginal efficiency of capital in the following way:

Supply Price = Discounted Prospective Yields

In the above formula, Sp stands for Supply Price or Replacement Cost and R1, R2, R3, … Rn , represent the annual prospective yields or the series of expected annual returns from the capital asset in the years, 1,2,3…and n; and i is that rate of discount which renders the annual prospective yields equal to the supply price of the capital asset. Thus, i represents the expected rate of profit or marginal efficiency of capital.

For example, if it costs 3000 rupees to invest in a certain machinery and the life of the machinery is two years. Suppose that in the first year the machinery is expected to yield income of Rs 1100 and in the second year Rs 2420. By substituting these values in the above formula, we can calculate the value of i, that is, the marginal efficiency of capital.

On calculating the value of i in the above equation it is found to be equal to 10. In other words, marginal efficiency of capital is here equal to 10 per cent. If we put the value of i, that is, 10 in the above equation, we obtain the following:

The relation between the present value and the rate of interest is shown in the above diagram, in this. the rate of interest is on the X-axis and the present value of the project on the Y-axis. PR curve shows the inverse relation between present value and rate of interest. If the current rate of interest is I1, the present value of the project is P1. When the interest rate I2 is higher, then present value P2 is lower than before. When the present value curve PR cuts the X-axis at point Z, the net present value becomes zero.

It is essential to compare the present value of the capital asset with its cost or supply price while purchasing the capital asset. If the present value of a capital asset exceeds its cost of buying, it is worth to buy it and if its present value is less than its cost, it is not worthwhile investing in this capital asset.

Investment Demand Curve- This investment demand curve shows how much investment will be undertaken by the entrepreneurs at various rates of interest. If the investment demand curve is less elastic, then investment demand will not increase much with the fall in the rate of interest. But if the investment demand curve or marginal efficiency of capital curve is very much elastic, then the changes in the rate of interest will bring about large changes in investment demand.

If the MEC is higher than the market rate of interest at which it is borrowed, it is worth to invest in the capital asset, and vice versa. If the MEC is lower than the rate of interest, no firm will borrow to invest in capital assets. If the market interest rate equals the MEC of the capital asset, the firm is said to possess the optimum capital stock. Thus, the equilibrium condition for a firm to hold the optimum capital stock is where the MEC equals the interest rate.

Investment Demand Curve

Above diagram shows the MEC curve of an economy. It has a negative slope (from left to right downward) which indicates that the higher the MEC, the smaller the capital stock. Or, as the capital stock increases, the MEC falls. This is because of the operation of the law of diminishing returns in production. When the capital stock is OK1, the MEC is Or1. As the capital increases from OK1 to OK2, the MEC falls from Or1 to Or2. To reach the optimum (desired) capital stock in the economy, the MEC must equal the rate of interest. If, as shown in the figure, the existing capital stock is OK1, the MEC is Or1 and the rate of interest is at Or2. The entrepreneur in the economy will borrow funds and invest in capital assets because MEC (Or1) is higher than the rate of interest (at Or2 ). This will continue till the MEC (Or1) comes down to the level of the interest rate (at Or2). When the MEC equals the rate of interest, the economy reaches the level of optimum capital stock. The fall in the MEC is due to the increase in the actual capital stock from OK1 to the optimum (desired) capital stock OK2. The increase in the firm’s capital stock by K1K2 is the net investment of the firm. Thus, the negative slope of the MEC curve indicates that the optimum stock of capital increases with the fall in the rate of interest.

FACTORS OTHER THAN THE INTEREST RATE AFFECTING INDUCEMENT TO INVEST:

Element of Uncertainty: The prospective yield of capital assets depends upon the business expectations. These business expectations are very uncertain. Because of uncertainty, investment projects usually have a short pay-off period and it is difficult to calculate the expected annual returns on the life of a capital asset. There is rapid change in technological developments and it makes capital assets obsolete earlier than their expected life. The rate of depreciation also does not remain constant and varies much. That’s why, firms have a tendency to invest only if they are in a position to recover the capital outlay in a short period. It brings instability in the investment function.

Existing Stock of Capital Goods: If the existing stock of capital goods is large and there is excess or idle capacity in the existing stock of capital assets, it would discourage potential investors from entering into the making of goods.

Level of Income: If the level of income rises in the economy with the rise in money wage rates, it will increase the demand for goods which will, in turn, raise the inducement to invest and vice versa.

Consumer Demand: If the demand for consumer goods is increasing rapidly, it will encourage more investment. Investment will be low if the demand is low, and vice versa.

Liquid Assets: If the investors possess large liquid assets, the inducement to invest is high. On the contrary, the inducement to invest is low for investors having little liquid assets.

Growth of Population: A rapidly growth of population grow the market for all types of goods in the economy. Investment will increase in all types of consumer goods industries as well as capital goods to meet the demand of an increasing population.

State Policy: The economic policies of the government have an important influence on the inducement to invest in the country. If the state levies heavy progressive taxes on corporations, it will discourage the inducement to invest. Altogether, heavy indirect taxation tends to raise the prices of commodities and adversely affects their demand and reduce the inducement to invest, and vice versa. On the other hand, if the state encourages private enterprise by providing credit, power and other facilities, inducement to invest will be high.

Inventions and Innovations: Inventions and technological improvements reduce costs by implimenting efficient methods of production and increase the MEC of new capital assets. Higher MEC will induce firms to make larger investments in the new capital assets.

New Products: If the sale prospects of a new product are high and the expected revenues are more than the costs, the MEC will be high and it will encourage investment.

Dr. Swati Gupta

Want to understand the concepts of Economics in a simple and better way?

Please visit my YouTube channel Learn Economics by Dr. Swati Gupta to view videos on multiple topics of Economics.

Please click on the image below to subscribe to this channel.

Comments

Post a Comment